Subscribe to discover Om’s fresh perspectives on the present and future.

Om Malik is a San Francisco based writer, photographer and investor. Read More

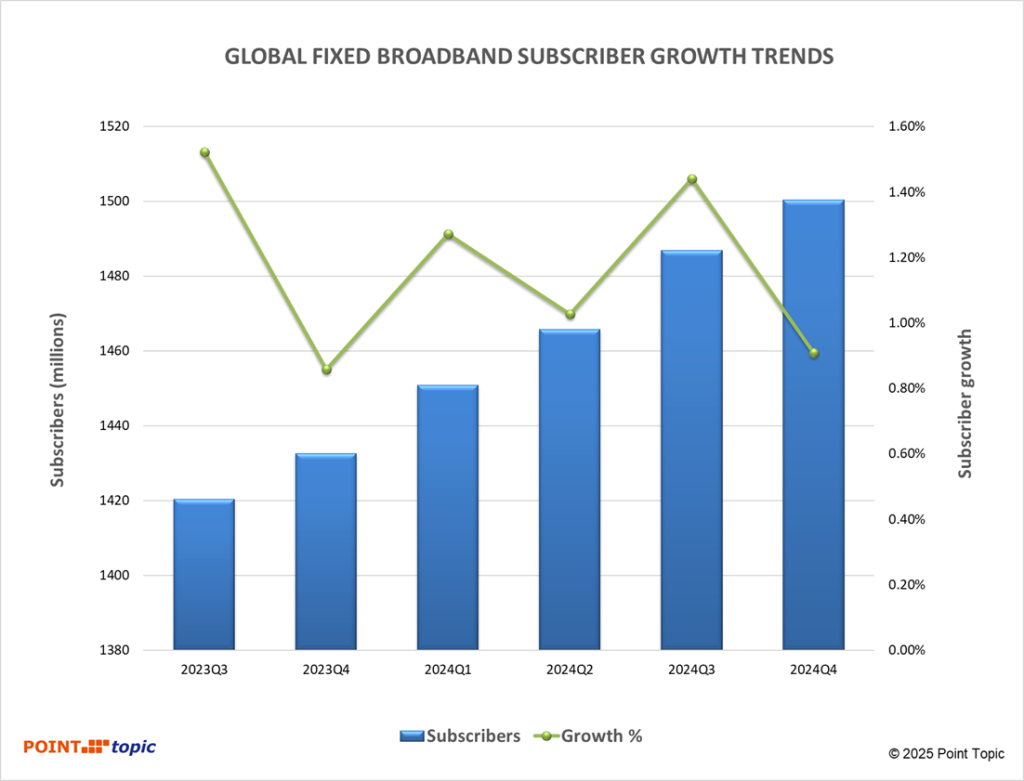

A new report by research firm Point Topic says there were more than 1.5 billion global broadband subscribers at the end of the fourth quarter of 2024. The real story, however, is the astonishing rise of two technologies gaining traction for connectivity: satellite broadband and fixed wireless. I say “astonishing” because in three decades of writing about broadband, I’ve witnessed countless failed attempts by both these technologies to gain traction.

In the late 1990s and early 2000s, I reported on numerous fixed wireless ventures like Teligent, XO Communications, and Winstar that promised to bypass the telecommunications monopolies. From lack of backhaul networks to limited access to rooftops for antennas, and most importantly unreliable hardware and networking gear, these technologies remained a distant dream.

Similarly, early satellite internet initiatives such as Teledesic (backed by Bill Gates) and Iridium (which went bankrupt before being rescued) promised global connectivity but delivered disappointing user experiences with high latency, limited bandwidth, and astronomical costs.

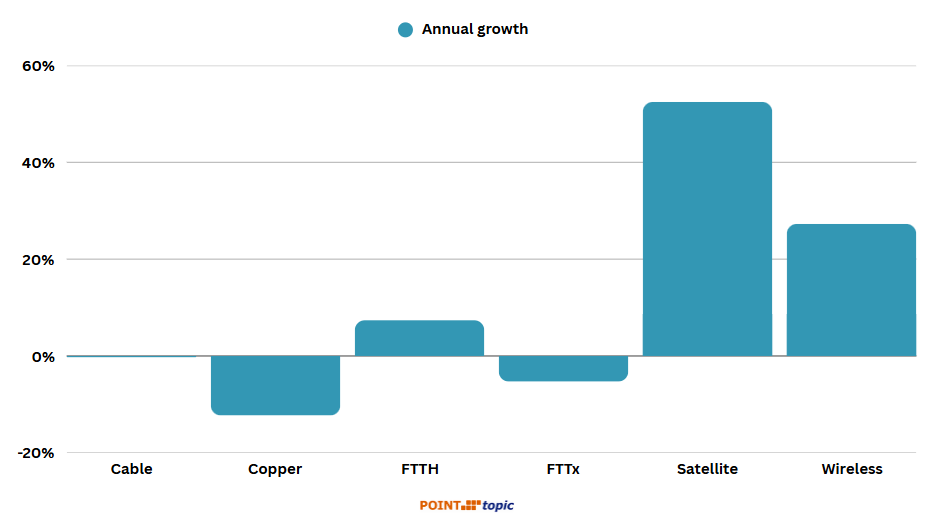

Now, nearly 25 years later, these once-failed technologies are finally having their moment—and for good reasons that weren’t feasible in those early days. The numbers tell a compelling story.

Satellite broadband surged 52.5% year over year, while fixed wireless access grew 27.3%. This growth contrasts sharply with traditional technologies: copper-based connections fell 12.3%, and cable declined 0.3%. Fiber (FTTH/B) remains the dominant technology, commanding 71.49% of the market share.

In major markets like the United States, where consumers faced average annual broadband cost increases of $195, fixed wireless access (FWA) providers reported 8.7% growth, while India saw a 61% jump in FWA adoption. These shifts suggest a fundamental transformation in global connectivity, with emerging technologies increasingly challenging traditional infrastructure in both developed and developing markets.

Starlink is the poster child of this transformation. With 4.6 million subscribers globally (more than 2 million in the United States alone), Elon Musk’s satellite venture has become a fierce competitor in just a few years. Its footprint is particularly telling—beyond the U.S., it’s seeing substantial adoption in Canada, Brazil, Australia, and Mexico. What do these markets have in common? Vast remote areas where traditional infrastructure deployment simply doesn’t make economic sense. Major U.S. telecommunications companies are heavily investing in FWA, with Verizon, AT&T, and T-Mobile reporting strong customer adoption. This growth often comes at the expense of traditional cable providers like Charter and Comcast, which are experiencing notable customer losses. FWA technology has proven particularly valuable in regions where maintaining aging copper networks is costly and fiber deployment faces logistical hurdles. The FWA technology’s global impact varies significantly by market. While the U.S. saw 8.7% growth in FWA adoption, India experienced a 61% increase.

When I got my first private T1 line installed in my tiny East Village apartment years ago, it felt like I was “the fastest gun in town.” Today, even a 1-gigabit-per-second connection feels “meh” to many urban dwellers, while millions still struggle to get reliable connectivity. As a fiber-connectivity diehard, I view both satellite and fixed wireless as secondary options. I use T-Mobile’s FWA as my backup connection. However, I must acknowledge that both FWA and satellite broadband have evolved beyond stopgap solutions into legitimate alternatives.

The economics are particularly compelling. With traditional broadband costs rising (U.S. consumers are now paying $195 more annually than they were just a few years ago), these alternative technologies offer a sweet spot of “good enough” performance at competitive prices. For example, my T-Mobile backup 5G Home costs $30 a month on top of my mobile phone bill. The total is still less than what I would have to pay Comcast for a cable broadband connection. This suggests that future broadband growth won’t be driven solely by speed improvements but by accessibility and cost-effectiveness.

It’s worth noting that fiber still dominates with 71.5% market share, and for good reason—it offers unmatched speed and reliability. But not everyone needs (or can afford) a fiber connection. Many households find that an FWA connection delivering 100-300 Mbps is perfectly adequate for their needs at a more attractive price point.

Over the past year, thanks to conversations with friends including Chetan Sharma of Chetan Sharma Consulting, I have come to realize that the question isn’t whether these alternative technologies will replace fiber—they won’t. Instead, we’re likely heading toward a hybrid future where different technologies serve different use cases and market segments.

Dense urban areas will continue to benefit from fiber’s unmatched capacity, while suburban and rural regions may find FWA and satellite options increasingly attractive. While they don’t deliver the multi-gigabit speeds fiber enthusiasts crave, these alternatives bring reliable connectivity to places where traditional broadband infrastructure isn’t economically viable.

The irony isn’t lost on me—technologies I once dismissed are now reshaping the broadband landscape. It’s a reminder that in technology, timing is everything: The right idea at the wrong time fails, but pair that idea with the right technological ecosystem and economic conditions, and yesterday’s failure becomes today’s breakthrough.

May 6, 2025. San Francisco

Comments are closed.

I’m lucky to have fiber to the home… I really enjoy being of Comcast and having having unlimited internet. I can work and do my activities with a family not worrying about caps.

I am interested in satellite as id like to put a house on hill – enjoy the view – and still have fast internet. It has always been a dream.

I’m retired and in a good place, but still have dreams 🙂